Austin, Jan. 29, 2025 (GLOBE NEWSWIRE) -- Chiplet Market Size & Growth Insights:

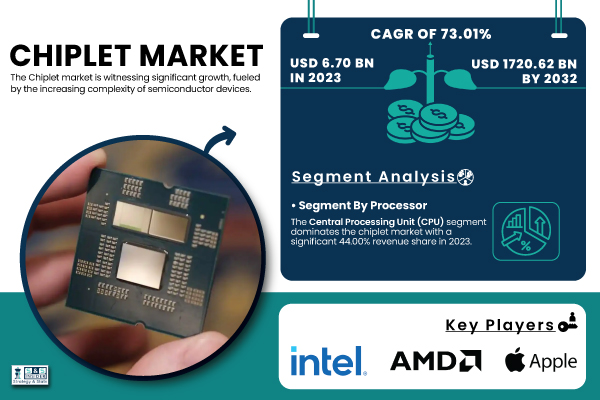

According to the SNS Insider, “The Chiplet Market Size was valued at USD 6.70 Billion in 2023 and is expected to reach USD 1720.62 Billion by 2032 and grow at a CAGR of 73.01% over the forecast period 2024-2032.”

Chiplet Market Growth Accelerates with U.S. Investments and Technological Advancements

The chiplet market is experiencing rapid growth due to increasing semiconductor complexity, demand for high-performance computing, and advancements in manufacturing technologies. Chiplets, modular chips that can be combined for customized solutions, offer enhanced performance, cost-efficiency, and faster time-to-market. The U.S. government recognizes their strategic value, as demonstrated by the CHIPS and Science Act, signed in August 2023. The act allocates USD 50 billion for semiconductor research, manufacturing, and innovation, including funding for fabrication facilities, regional technology hubs, and research initiatives, which will strengthen the domestic semiconductor industry.

Get a Sample Report of Chiplet Market Forecast @ https://www.snsinsider.com/sample-request/5567

Leading Market Players with their Product Listed in this Report are:

- Intel Corporation (Intel Core Processors, Intel Optane Memory)

- Advanced Micro Devices, Inc. (AMD Ryzen Processors, AMD Radeon Graphics)

- Apple Inc. (iPhone, MacBook Pro)

- IBM (IBM Cloud, IBM Watson)

- Marvell (Marvell ThunderX2, Marvell 8000 Series)

- MediaTek Inc. (MediaTek Dimensity, MediaTek Helio)

- NVIDIA Corporation (NVIDIA GeForce, NVIDIA Tesla)

- Achronix Semiconductor Corporation (Speedster7t FPGAs, Speedster 22i FPGAs)

- Ranovus (LightChip 2, Photonic Interconnect)

- Netronome (Agilio CX, Agilio FLX)

- Cadence Design Systems, Inc. (Virtuoso, Allegro)

- SiFive, Inc. (SiFive Freedom, SiFive Performance)

- ALPHAWAVE SEMI (Quantum, AlphaWaves Interconnect)

- Eliyan (Eliyan Vision, Eliyan Cloud)

- Ayar Labs, Inc. (TeraPHY, Optical Interconnects)

- Tachyum (Prodigy Processor, Tachyum Cloud)

- X-Celeprint (X-Celeprint Chip, X-Celeprint Platform)

- Kandou Bus SA (Kandou Phy, Kandou Clock)

- NHanced Semiconductors (NHanced XLR, NHanced DSP)

- Tenstorrent (Tenstorrent Processor, Tenstorrent AI).

Chiplet Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 6.70 Billion |

| Market Size by 2032 | USD 1720.62 Billion |

| CAGR | CAGR of 73.01% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Processor (Field-Programmable Gate Array (FPGA), Graphics Processing Unit (GPU), Central Processing Unit (CPU), Application Processing Unit (APU), Artificial Intelligence Application-specific Integrated Circuit (AI ASIC) Coprocessor) • By Packaging Technology (System-in-Package (SiP), Flip Chip Chip Scale Package (FCCSP), Flip Chip Ball Grid Array (FCBGA), 2.5D/3D, Wafer-Level Chip Scale Package (WLCSP), Fan-Out (FO)) • By End-use Applications (Enterprise Electronics, Consumer Electronics, Automotive, Industrial Automation, Healthcare, Military & Aerospace, Others) |

| Key Drivers | • Increased Demand for High-Performance Computing Systems Drives the Growth of the Chiplet Market. • Cost-Effectiveness and Time-to-Market Efficiency Fueling Chiplet Market Expansion. |

Do you Have any Specific Queries or Need any Customize Research on Chiplet Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/5567

Automotive and CPU Segments Dominate in 2023, While Enterprise Electronics and GPUs Lead Future Growth

By End-Use Application

In 2023, the automotive segment dominates the chiplet market with a 32.00% revenue share, driven by the shift toward EVs, autonomous driving, and enhanced vehicle connectivity. Chiplets' modularity allows automakers to integrate specialized components for processing, memory, and I/O in a single package.

The enterprise electronics segment is projected to grow at the highest CAGR of 75.47%, fueled by the rising demand for scalable, energy-efficient chips in data centers, cloud computing, and networking to handle complex workloads efficiently.

By Processor

In 2023, the CPU segment leads the chiplet market with a 44.00% revenue share, driven by growing demand for faster, energy-efficient processors in enterprise electronics, automotive, and consumer sectors. Chiplet architectures, used in AMD EPYC and Intel Xeon processors, enhance multi-core processing and system performance.

The GPU segment is set to grow at the highest CAGR of 76.55%, fueled by applications in AI, gaming, and high-performance computing, with innovations like NVIDIA’s A100 Tensor Core and AMD’s RDNA 2 architectures driving efficiency and power.

Asia Pacific Leads Chiplet Market While North America Emerges as the Fastest-Growing Region

In 2023, Asia Pacific holds the largest share of the chiplet market at approximately 42.00%, driven by its advanced semiconductor manufacturing infrastructure, major chip manufacturers, and rapid growth in industries like consumer electronics and automotive. Companies like TSMC are leveraging 3D packaging and heterogeneous integration technologies to innovate chiplet designs. Meanwhile, North America is the fastest-growing region with a projected CAGR of 74.95%, fueled by the rising adoption of chiplet solutions in data centers, high-performance computing, and automotive sectors. U.S. government initiatives like the CHIPS and Science Act, which allocates USD 50 billion to boost semiconductor manufacturing and R&D, have significantly supported growth. Leaders like Intel and NVIDIA are advancing chiplet integration in their processors and GPUs.

Purchase Single User PDF of Chiplet Market Report (33% Discount) @ https://www.snsinsider.com/checkout/5567

Recent Development

- March 13, 2024 – Intel researchers have unveiled a novel approach to enhance power efficiency and reliability in chiplet-based systems, leveraging UCIe architecture by reducing circuit frequencies. This innovation aims to deliver significantly higher performance with lower power consumption, addressing growing demands in modern System-in-Package (SiP) designs.

- December 11, 2024 – Apple is collaborating with Broadcom to develop a custom AI chipset, "Baltra," launching in 2026, leveraging Broadcom's expertise in interconnect designs and 3.5D packaging for enhanced chip performance.

- March 18, 2024 – NVIDIA has launched the Blackwell platform, featuring a new GPU architecture that enables real-time generative AI on trillion-parameter models, reducing operating costs and energy consumption by up to 25x.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Patent Filings by Region

5.2 Adoption Rate by Region

5.3 Supply Chain and Production Volume.

5.4 Cost Efficiency by Region

5.5 R&D Investment

6. Competitive Landscape

7. Chiplet Market Segmentation, by Packaging Technology

8. Chiplet Market Segmentation, by Processor

9. Chiplet Market Segmentation, by End-use Applications

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access More Research Insights of Chiplet Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/chiplet-market-5567

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.