Austin, March 21, 2025 (GLOBE NEWSWIRE) -- Extreme Ultraviolet (EUV) Lithography Market Size & Growth Insights:

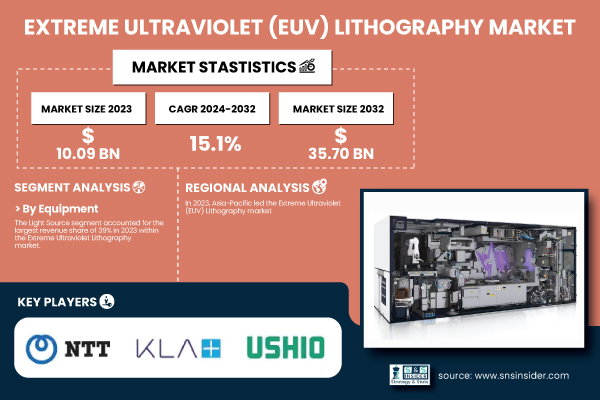

According to the SNS Insider,“The Extreme Ultraviolet (EUV) Lithography Market Size was valued at USD 10.09 Billion in 2023 and is expected to reach USD 35.70 Billion by 2032 and grow at a CAGR of 15.1% over the forecast period 2024-2032.”

Extreme Ultraviolet Lithography Market: Driving Forces and Industry Trends

The EUV Lithography market is driven by technological advancements, increasing semiconductor complexity, and the demand for smaller, more powerful chips. Industries like AI, high-performance computing, 5G, and IoT are fueling the need for advanced processors, pushing semiconductor manufacturers to invest in EUV technology for precise sub-7nm node production. Major players such as Intel, TSMC, and Samsung are adopting EUV lithography to enhance chip performance, reduce power consumption, and maintain a competitive edge.

Get a Sample Report of Extreme Ultraviolet (EUV) Lithography Market Forecast @ https://www.snsinsider.com/sample-request/5902

Leading Market Players with their Product Listed in this Report are:

- ASML Holding NV (EUV Lithography Machines, High-NA EUV Lithography Systems)

- Carl Zeiss AG (EUV Lithography Optics, EUV Mask Inspection Systems)

- NTT Advanced Technology Corporation (EUV Mask Blanks, EUV Mirror Coatings)

- KLA Corporation (EUV Mask Inspection Tools, Actinic Patterned Mask Inspection Systems)

- ADVANTEST CORPORATION (EUV Mask Defect Inspection Systems, Semiconductor Wafer Testing Solutions)

- Ushio Inc. (EUV Light Source Modules, EUV Mask Cleaning Systems)

- SUSS MicroTec SE (EUV Mask Aligners, EUV Lithography Coating and Developing Systems)

- AGC Inc. (EUV Mask Blanks, EUV Pellicles)

- Lasertec Corporation (EUV Mask Inspection Equipment, EUV Mask Defect Review Systems)

- TOPPAN Inc. (EUV Photomasks, EUV Mask Blanks)

- Canon Inc. (EUV Mask Metrology Tools, Nanoimprint Lithography Systems)

- Nikon Corporation (EUV Lithography Equipment, EUV Metrology and Inspection Tools)

- Intel Corporation (EUV Process Nodes, EUV-Based High-Performance Computing Chips)

- Taiwan Semiconductor Manufacturing Company Limited (EUV Lithography for 3nm Process, EUV-Based Chip Manufacturing Services)

- Samsung Electronics Co. Ltd. (EUV-Based DRAM and Logic Chips, EUV Lithography for 3nm and 5nm Nodes)

- Toppan Photomasks Inc. (EUV Photomasks, EUV Mask Blanks)

- ZEISS Group (EUV Lithography Optical Systems, EUV Reticle Inspection Tools).

Extreme Ultraviolet (EUV) Lithography Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 10.09 Billion |

| Market Size by 2032 | USD 35.70 Billion |

| CAGR | CAGR of 15.1% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Equipment (Light Source, Optics, Mask, Others) • By End Use (Integrated Device Manufacturer (IDM), Foundries) |

| Key Drivers | • Increasing Demand for Advanced Semiconductor Chips Drives Growth in the Extreme Ultraviolet Lithography Market. • Rising Demand for AI, 5G, and IoT Technologies Creates New Growth Opportunities in the Extreme Ultraviolet Lithography Market. |

Do you Have any Specific Queries or Need any Customize Research on EUV Lithography Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/5902

Rising R&D investments, industry collaborations, and innovations in photomask and resist materials further accelerate market growth. However, supply chain challenges, high costs, and skilled labor shortages pose constraints, while government policies in the U.S., China, and the EU play a pivotal role in shaping the industry's direction. Additionally, environmental concerns, patent trends, and regulatory landscapes influence market dynamics, driving sustainable practices in semiconductor manufacturing.

Extreme Ultraviolet Lithography Market: Light Source Leads, Masks & Foundries Surge

By Equipment

The Light Source segment led the Extreme Ultraviolet Lithography market with a 39% revenue share in 2023, driven by the demand for high-intensity, stable EUV light sources for advanced semiconductor manufacturing. Companies like Ushio Inc. and Gigaphoton Inc. are enhancing laser-produced plasma (LPP) light sources to boost power and stability.

The Mask segment is set to grow at a 16.4% CAGR due to advancements in defect-free EUV photomasks essential for sub-7nm nodes. Key players like ZEISS, Toppan Photomasks, and AGC Inc. are innovating EUV masks, ensuring higher precision, improved yield, and enhanced lithography efficiency for AI and 5G applications.

By End Use

The Integrated Device Manufacturer (IDM) segment led the Extreme Ultraviolet Lithography market with a 63% revenue share in 2023, driven by major players like Intel, Samsung, and Micron investing heavily in EUV for advanced chip production. Micron's $100 billion investment in EUV-based DRAM manufacturing highlights the push for sub-5nm nodes.

The Foundries segment is set to grow at a 16.06% CAGR, fueled by rising demand for contract chip manufacturing. TSMC, GlobalFoundries, and SMIC are expanding EUV-based 3nm and 2nm nodes to support AI, autonomous vehicles, and IoT growth, ensuring continued advancements in semiconductor fabrication.

Asia-Pacific Leads, North America Emerges as Fastest-Growing EUV Lithography Market

In 2023, Asia-Pacific dominated the Extreme Ultraviolet (EUV) Lithography market with a 41% share, driven by major semiconductor manufacturers like TSMC, Samsung, and SMIC investing in sub-7nm and 3nm chip production. China’s push for semiconductor self-sufficiency and Japan’s advancements in EUV photomasks further strengthened the region’s leadership.

North America is the fastest-growing market, with a 16.3% CAGR, fueled by the U.S. CHIPS Act’s USD 52 billion funding for semiconductor manufacturing. Intel, Micron, and GlobalFoundries are expanding EUV adoption, particularly for Intel 4 and next-gen DRAM. ASML collaborations on high-NA EUV technology further accelerate North America’s growth.

Purchase Single User PDF of Extreme Ultraviolet Lithography Market Report (33% Discount) @ https://www.snsinsider.com/checkout/5902

Recent Development

- Jan 29, 2025 – ASML Sees Record €3 Billion in EUV Orders Amid AI BoomASML reported a surge in net bookings, driven by soaring demand for its advanced EUV machines as AI and high-performance computing fuel semiconductor growth.

- Apr 26, 2024 – Samsung's Jay Y. Lee Strengthens EUV Partnership with Zeiss Samsung’s Jay Y. Lee met Zeiss CEO Karl Lamprecht to expand collaboration on next-gen EUV and semiconductor technologies, aiming to challenge TSMC’s leadership.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Investment & R&D Spending (2023)

5.2 EUV Equipment Shipments

5.3 Supply Chain Statistics (2023)

5.4 Government Subsidies & Incentives

6. Competitive Landscape

7. Extreme Ultraviolet (EUV) Lithography Market Segmentation, by Equipment

8. Extreme Ultraviolet (EUV) Lithography Market Segmentation, by End Use

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access More Research Insights of Extreme Ultraviolet (EUV) Lithography Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/extreme-ultraviolet-lithography-market-5902

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.