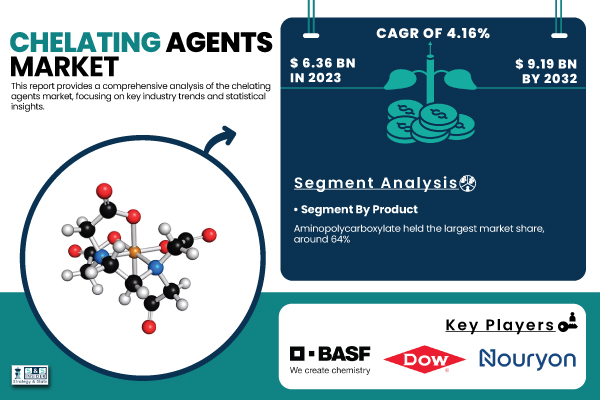

Austin, April 28, 2025 (GLOBE NEWSWIRE) -- The Chelating Agents Market Size was valued at USD 6.36 Billion in 2023 and is expected to reach USD 9.19 Billion by 2032, growing at a CAGR of 4.16% over the forecast period of 2024-2032.

Download PDF Sample of Chelating Agents Market @ https://www.snsinsider.com/sample-request/6302

Sustainability and Industrial Efficiency Drive Demand for Eco-Friendly Chelating Agents Across Key Sectors

Chelating agents are witnessing surging demand due to their crucial role in enhancing product efficiency and preventing metal ion contamination across cleaning, water treatment, pulp & paper, and pharmaceutical industries. A growing shift toward eco-friendly alternatives, supported by regulatory bodies like the U.S. Environmental Protection Agency (EPA), is propelling adoption. Agents such as GLDA and MGDA are being favored for water treatment, while the American Cleaning Institute (ACI) reports a rise in phosphate-free detergent formulations using chelating agents. Industry leaders like BASF and Nouryon are making strides with sustainable technologies, including BASF’s Trilon® M, recognized for its high performance and biodegradability. Between 2022 and 2024, green chemistry initiatives have significantly influenced the market, reinforcing the alignment of sustainability and industrial innovation as a key growth catalyst.

The US Chelating Agents Market Size was valued at USD 1.319 Billion in 2023 with a major share of about 74% and a significant growth rate.

The U.S. Chelating Agents market is witnessing strong growth due to increased demand from the household cleaning and personal care industries. The push toward phosphate-free cleaning agents is supported by regulatory frameworks such as the EPA Safer Choice Program. Companies like Procter & Gamble are reformulating products with safer chelating agents such as EDDS and GLDA, boosting market growth through sustainable product development.

Key Players:

- BASF SE (Trilon, Lutensit)

- Dow Inc. (Versene, Violet)

- Nouryon (Dissolvine, Ferrazone)

- Kemira Oyj (KemEcal, KemGuard)

- Mitsubishi Chemical Holdings Corporation (Aminotron, Aminotron Plus)

- Lanxess AG (Baypure, Bayhibit)

- Hexion Inc. (EpiKure, EpiRez)

- Archer Daniels Midland Company (ADM) (Citric Acid, Sodium Citrate)

- Ascend Performance Materials (FlexaTrac-NTA, FlexaTrac-DTA)

- MilliporeSigma (Chelex 100 Resin, Calcium Disodium EDTA)

- Nippon Shokubai Co., Ltd. (Acrylic Acid, Acrylates)

- Tate & Lyle PLC (Tate & Lyle Citric Acid, Tate & Lyle Sodium Citrate)

- Shandong IRO Chelating Chemical Co., Ltd. (EDTA-2Na, EDTA-4Na)

- New Alliance Fine Chem Pvt. Ltd. (Zinc EDTA, Calcium DTPA)

- Starco Arochem Pvt. Ltd. (Ecoquest CL 100, Starcochel FS 1030)

- Adinath Auxi Chem Pvt. Ltd. (ADILON SAM, ADILON SPIN)

- American International Ingredients, Inc. (EDTA, Sodium Citrate)

- Merck KGaA (EDTA Disodium Salt, EDTA Tetrasodium Salt

- Nagase & Co., Ltd. (Nagase Chelate, Nagase Chelate II)

- Zhonglan Industry Co., Ltd. (EDTA-2K, EDTA-4K)

Chelating Agents Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 6.36 Billion |

| Market Size by 2032 | USD 9.19 Billion |

| CAGR | CAGR of 4.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Sodium gluconate, Organophosphonates, Aminopolycarboxylate, Others) • By Application (Household & industrial cleaning, Pulp & Paper, Chemical processing, Water treatment, Agrochemicals, Consumer Products, Pharmaceutical, Others) |

| Key Drivers | • The growing demand for biodegradable and sustainable chelating agents drives market expansion across multiple industries. |

Key Raw Material Pricing Trends Influencing Chelating Agents Market

- Prices fluctuate due to reliance on crude oil and natural gas-based inputs like EDTA and phosphonates.

- Demand for renewable sources like sugarcane and corn raises costs but supports sustainable production.

- Instability in Asia from 2022–2024 caused price spikes for key synthetic raw materials.

- Environmental regulations in the U.S. and EU have increased processing costs for non-biodegradable agents.

- Companies like BASF mitigate raw material volatility through long-term supplier contracts.

By Product, Aminopolycarboxylate Segment Dominated the Chelating Agents Market in 2023 with a 64% Market Share

This is attributed to their high efficiency in complexing metal ions across multiple industrial processes. Aminopolycarboxylates, including EDTA and NTA, are widely used in detergents, water treatment, and pulp & paper. Their ability to function under alkaline and high-temperature conditions makes them indispensable in industrial cleaning. In the pulp & paper sector, these agents help prevent scaling and enhance bleaching by binding calcium and magnesium ions. For instance, Kemira Oyj, a global pulp & paper chemical provider, emphasizes the use of aminopolycarboxylates to optimize water circuits and reduce downtime. While environmental concerns about EDTA persist, newer variants like IDS (iminodisuccinic acid) are offering similar efficiency with better biodegradability. This mix of industrial performance and ongoing green innovation has solidified aminopolycarboxylates' position as the most preferred category in 2023.

By Application, Pulp & Paper Segment Dominated the Chelating Agents Market in 2023 with a 27% Market Share

This leadership is driven by the critical role of chelating agents in the bleaching process, where they remove transition metals that interfere with hydrogen peroxide stability. The agents ensure brighter pulp output and reduce chemical consumption. The U.S. and Scandinavian paper industries, in particular, are deploying chelating agents to enhance eco-efficiency. According to the American Forest & Paper Association, sustainable pulp processing practices, including reduced water and energy consumption, are increasingly integrating chelating agents to improve system performance and reduce downtime. Products like DTPA and EDTA are standard additives in kraft and mechanical pulping operations. Additionally, the rise in demand for recycled paper products further fuels the use of chelating agents, as recycled fibers often contain higher metal ion concentrations that require chelation.

Asia Pacific Dominated the Chelating Agents Market In 2023, Holding a 42% Market Share.

Asia Pacific held the largest share in the Chelating Agents Market in 2023 due to rapid industrial expansion and agricultural chemical use. The region is home to high-growth economies like China and India, where water treatment, textile, and agrochemical applications dominate. According to India’s Ministry of Chemicals and Fertilizers, the increased use of micronutrient-based chelates in fertilizers is rising sharply due to soil nutrient depletion. Furthermore, China’s National Development and Reform Commission (NDRC) has endorsed eco-friendly agents for water treatment and textile applications. Additionally, the presence of major manufacturing hubs and cost-effective raw materials encourages domestic production of chelating agents in this region, making Asia Pacific the epicenter for both consumption and manufacturing.

If You Need Any Customization on Chelating Agents Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6302

North America Emerged as the Fastest Growing Region in Chelating Agents Market with A Significant Growth Rate in The Forecast Period

The U.S. leads regional growth due to stringent environmental regulations and rapid adoption of eco-certified cleaning and personal care products. According to the EPA's Safer Choice Program, more than 60% of certified laundry and dishwashing products in 2023 contained biodegradable chelating agents. In parallel, the American Cleaning Institute (ACI) has reported a 15% year-over-year increase in the use of non-phosphorus chelating agents in household products. The growing use in water treatment especially in the southwestern U.S., where hard water is prevalent is also contributing to demand. Major retailers are increasingly requiring green formulations, and U.S.-based companies such as Ecolab and SC Johnson are expanding their portfolios to include biodegradable chelating formulations, further driving the regional growth trajectory.

Recent Developments

- January 2025: Nouryon’s Herkenbosch site received ISCC PLUS certification, validating its use of sustainable, bio-based inputs in chelating agent production.

- June 2024: A new chelating agent in PSMA therapy showed reduced toxicity and improved stability, enhancing safety in prostate cancer treatment.

- October 2023: Nouryon launched Dissolvine GL Premium, a biodegradable chelating agent for sustainable cleaning, at the 2023 SEPAWA Congress.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Chelating Agents Market Segmentation, By Product

8. Chelating Agents Market Segmentation, By Application

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practice

12. Conclusion

Read Our Trending Reports:

Lignin Market Share & Forecast to 2032

Water Treatment Chemicals Market Trends Research by 2032

Industrial Wastewater Treatment Chemicals Market - Global Research by 2032

Industrial Cleaning Chemical Market Analysis by 2032

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.