Pune, May 23, 2025 (GLOBE NEWSWIRE) -- Data Center Blade Server Market Size Analysis:

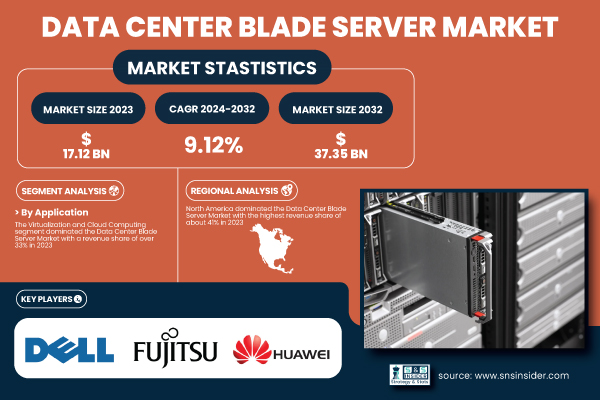

“According to the SNS Insider report, the Data Center Blade Server Market size was valued at USD 17.12 billion in 2023 and is projected to reach USD 37.35 billion by 2032, growing at a CAGR of 21.03% during the forecast period of 2024-2032.”

Get a Sample Report of Data Center Blade Server Market@ https://www.snsinsider.com/sample-request/6288

Major Players Analysis Listed in this Report are:

- Cisco Systems, Inc. (Cisco UCS B-Series Blade Servers, Cisco Nexus 9000 Series)

- Dell Inc. (PowerEdge M-Series Blade Servers, Dell VRTX)

- FUJITSU (PRIMERGY BX900 Blade Servers, Fujitsu Integrated System PRIMEFLEX)

- Hewlett Packard Enterprise Development LP (HPE BladeSystem c-Class, HPE Synergy)

- Huawei (FusionServer Pro 2288H V5 Blade Servers, Huawei CloudEngine Blade Switches)

- IBM (IBM BladeCenter HS23, IBM Power Systems Servers)

- INSPUR Co., Ltd. (Inspur NF5280M5 Blade Servers, Inspur AS9000 Blade Servers)

- Lenovo (Lenovo ThinkSystem SN550 Blade Server, Lenovo Flex System x240 Blade Server)

- Oracle (Oracle Server X8-2, Oracle Sun Blade 6000)

- Super Micro Computer, Inc. (SuperBlade 8019, Supermicro TwinPro Blade Servers)

- H3C (H3C UniBlade Series, H3C S12500X Blade Switch)

- Mellanox Technologies (Mellanox Spectrum Ethernet Switch, Mellanox InfiniBand ConnectX Adapter)

- Broadcom (Broadcom Ethernet Adapters, Broadcom NetXtreme II 10GbE Blade)

- Sugon (Sugon 7200 Blade Server, Sugon 5100 Blade Server)

- Wiwynn (Wiwynn M-series Blade Servers, Wiwynn T-series Servers)

- Quanta Computer (Quanta Blade Servers, QuantaGrid D52B-1U Servers)

- Netronome (Netronome Agilio CX, Agilio SmartNICs)

Data Center Blade Server Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 17.12 Billion |

| Market Size by 2032 | USD 37.35 Billion |

| CAGR | CAGR of 9.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | Rising Demand for High-Performance Servers to Manage Increasing Business Data Drives Growth in Data Center Blade Server Market |

Do you have any specific queries or need any customization research on Data Center Blade Server Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/6288

U.S. Data Center Blade Server Market Forecast: $11.04B by 2032 on AI, Hyperscale, and Edge Trends

The U.S. Data Center Blade Server Market was valued at USD 5.0 billion in 2023 and is projected to reach USD 11.04 billion by 2032, growing at a CAGR of 9.19% from 2024 to 2032. Growth is driven by increasing demand for high-density computing, AI workloads, and energy-efficient infrastructure. Future outlook remains strong due to rising investments in hyperscale data centers and advancements in edge computing technologies.

By Form Factor: Half-Height Leads, Full-Height Grows Fastest

Half-Height Blade Server segment dominated the market in 2023 with 50% of the revenue share owing to a balance between performance and compactness which is ideal for various data center functionality. These servers, in turn, are favoured since they can provide higher compute density with less energy usage and easier cooling. Enterprises embrace these to optimize rack space and save operational costs, particularly in large-scale virtualization environments.

Full-Height Blade Server segment is expected to register the fastest CAGR during the forecast period 2024-2032. With a larger form factor, they provide higher compute power, memory capacity, and GPU support, which makes them perfect for AI, ML, and high-performance computing workloads. This, in turn, makes them a very important asset in verticals such as healthcare and any kind of research driven discipline — where processing power is key.

By Channel: Direct Channel Dominates, Resellers Grow Fastest

Due to established relationships between large enterprises and manufacturers, controlling customization and technical support, the Direct channel dominated the market and was more favorable in cost-effectiveness among the channels with a revenue share of 51% in 2023. They capitalize on the need for customized blade server configuration and quicker time to deployment. Direct purchasing for integrated services and better scalability is more attractive to key sites where heavy infrastructure is a requirement.

During the forecast period, the Reseller segment is expected to grow at the fastest CAGR. With enterprises of small and mid-sized stature making strides in their IT spends, they end up enlisting the help of resellers to provide them with bundled solutions, combined with after-sales support and flexible financing arrangements. With their compact cross-sectional pricing with various brands, resellers help create competitive and more diverse offerings, appealing to cost-conscious buyers.

By Application: Virtualization & Cloud Computing Dominates, AI & ML Workloads Surge Ahead

The Virtualization and Cloud Computing segment was the leading application segment in 2023, garnering 33% of revenue share in 2023, owing to the global migration to virtualized environments and cloud infrastructure. Blade servers provide a perfect architecture for sharing the same physical hardware among various virtual machines, improving operational efficiency, and reducing costs. This segment is being propelled by enterprises moving to adopt private and hybrid clouds.

The fastest-growing segment is expected to be AI and Machine Learning Workloads. Demand for high-performance and low-latency compute infrastructure increases as businesses use AI/ML to derive insights and automate processes. Blade servers, in particular those that include GPUs, are enabled to parse these increasingly complex algorithms and train more complicated deep learning models, paving the way for emulsifying deep learning in the near term.

By End-Use: BFSI Leads, IT & Telecom Expands Rapidly

In 2023, the BFSI sector occupied the largest market share in blade servers. The financial Institutions would need real-time processing, high data security, and maximum uptime. In financial operations and digital banking platforms, these requirements are at the heart of operations and blade servers provide modular, redundant systems that keep businesses running and growing.

IT & Telecom segment is expected to register the highest CAGR. 5G rollouts, edge computing and demand for data services are transforming this sector. That's a new class of applications that require low-latency as well as geo-distributed data centres, which makes them an obvious fit for telecom providers who have been looking to modernize how they scale their operations for a long time now.

Data Center Blade Server Market Segmentation:

By Form Factor

- Half-height Blade Server

- Full-height Blade Server

- Quarter-height Blade Server

By Channel

- Direct

- Reseller

- Systems Integrator

- Others

By Application

- Virtualization and Cloud Computing

- High-performance Computing (HPC)

- Storage and Backup

- Web Hosting

- Database Management

- AI and Machine Learning Workloads

By End-use

- BFSI

- Healthcare

- Energy

- IT & Telecom

- Government & Defense

- Others

By Region: North America Dominates, Asia-Pacific Accelerates

North America held the dominant position, and accounted for 41% revenue share in 2023, owing to the presence of large data center operators, advanced adoption of emerging technologies such as AI, edge computing, and 5G technology, and a keen focus on sustainable, and green IT infrastructure. This led North America to retain its dominance in the blade server market.

Asia-Pacific is anticipated to achieve the fastest CAGR during 2024–2032 due to the rapid digital transformation, increase in adoption of cloud service, and numerous government initiatives taken by countries such as China, India, and Japan. The demand for scalable and high-performance server solutions in the region is boosted by the investments in AI, IoT, and smart city development.

Buy an Enterprise-User PDF of Data Center Blade Server Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/6288

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Data Center Blade Server Market Segmentation, By Form Factor

8. Data Center Blade Server Market Segmentation, By Application

9. Data Center Blade Server Market Segmentation, By End-use

10. Data Center Blade Server Market Segmentation, By Channel

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

Enterprises Embrace Robotics to Enhance U.S. Data Center Efficiency and Uptime

U.S. Data Center GPU Market Forecast to Hit $43.8B by 2032 Amid AI and ML Surge

U.S. Multi-Tenant Data Center Market Grows with Increased Demand for Colocation and Cloud Services