Austin, July 23, 2025 (GLOBE NEWSWIRE) -- Hedge Fund Market Size Analysis:

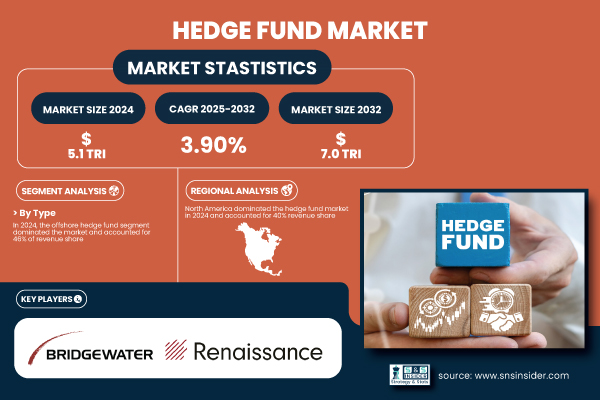

The SNS Insider report indicates Hedge Fund Market size was valued at USD 5.1 trillion in 2024, estimated to reach USD 7.0 trillion by 2032, growing at a CAGR of 3.90% from 2025 to 2032.

The U.S. hedge fund market is driven by concentrated institutional investor activity, dynamic AI-enabled trading platforms, and robust regulatory infrastructure. The market was valued at USD 0.7 trillion in 2024 and is projected to reach USD 1.0 trillion by 2032, growing at a CAGR of 3.78%. Continued innovation in digital asset strategies and increased demand for diversified alpha generation will fuel sustained expansion.

Get Free Sample Report of the Hedge Fund Market: https://www.snsinsider.com/sample-request/6889

Key Hedge Fund Companies Profiled in the Report:

- Bridgewater Associates

- Renaissance Technologies

- Man Group

- AQR Capital Management

- Two Sigma Investments

- Millennium Management

- Elliott Investment Management

- Citadel LLC

- BlackRock

- DE Shaw & Co.

- Baupost Group

- Pershing Square Capital

- Viking Global Investors

- Point72 Asset Management

- Third Point LLC

- Others included in the report

Hedge Fund Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | US$ 5.1 trillion |

| Market Size by 2032 | US$ 7.0 trillion |

| CAGR | CAGR of 3.90% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

Segment Analysis

By Type: Offshore Dominates, Fund of Funds Sees Fastest Growth

Offshore hedge funds dominated the market in 2024 and accounted for 46% of revenue share, as they offer tax benefits, looser regulations, and are attractive to institutional investors outside of the US looking to maximize returns through multi-jurisdictional strategies. These funds typically operate from a jurisdiction such as the Cayman Islands or Bermuda, offering the practical advantages of lower operating costs and privacy, appealing to both high-net-worth individuals and institutions.

The Fund of Funds segment is expected to register the fastest CAGR during the forecast period, as it allows for diversification of risk and access to a wide variety of investments. Such funds enable investors to access multiple hedge strategies in one vehicle, mitigating idiosyncratic manager risk. This model is attractive to new investors and institutions seeking balanced exposure and lowering compliance overhead, increasing its adoption rate, particularly across the Asia-Pacific and European markets.

By Strategy: Long/Short Equity Dominates, Global Macro Grows Fastest

Long/short equity segment dominated the market in 2024 and accounted for a significant revenue share. Its core allure is its capability to produce alpha during upswings and downturns alike. Fund managers can mitigate risk while still maximizing for absolute returns by going long on cheap stocks and short on expensive ones. Such flexibility across volatile and stable economic cycles makes it appealing and secures its position as one of the leaders among hedge strategies.

The Global Macro strategies segment is witnessing the fastest CAGR, driven by geopolitical unrest, inflation fluctuations, and changing interest rate environments. These macroeconomic cross-currency/comodity and sovereign debt arb strategies represent an agile toolbox while capitalizing on global inefficiencies. Increasingly data-driven global macro funds, some of which are aided by AI and machine learning-improved predictive analytics, continue to attract generation Jason Trennert and other sophisticated institutional investors.

By Region: North America Leads, Asia-Pacific Surges Forward

North America dominated the hedge fund market in 2024 and accounted for 40% of revenue share, supported by its deep capital markets, concentration of institutional investors, and the maturity of its regulatory environment. Earlier, Hedge strategies, fintech integration, and High-frequency trading technologies will continue to call the U.S. home, and thus leadership will be maintained through 2032.

Asia-Pacific is registering the fastest CAGR, owing to the rise in the number of rich populations, liberalizing financial regulations, and growing penetration of fintechs. International capital flows from both domestic and global investors, leading to the establishment of regional hedge fund hubs such as Singapore, Hong Kong, and India, creating access points to invest in high-growth markets and digital asset innovation across different geographies.

For a Personalized Briefing with Our Industry Analysts, Connect Now: https://www.snsinsider.com/request-analyst/6889

Recent Developments in the Hedge Fund Market – 2024

- June 2024 – Bridgewater Associates announced the launch of a new tokenized hedge fund aimed at institutional clients focused on blockchain-integrated sovereign debt strategies.

- May 2024 – Citadel partnered with BlackRock to co-develop AI-driven macro hedge strategies, enhancing predictive capabilities in volatile interest rate environments.

- April 2024 – Man Group expanded its footprint in Asia by opening a hedge fund incubator in Singapore, targeting local fintech collaborations.

- March 2024 – Millennium Management acquired a majority stake in a crypto-focused hedge fund to strengthen its position in decentralized finance markets.

- February 2024 – Two Sigma launched an ESG-integrated hedge fund tailored to sustainability-focused institutional investors in Europe.

- January 2024 – AQR Capital Management rolled out a retail-facing fund of funds platform to broaden hedge strategy access for non-institutional investors.

Key Segments:

By Type

- Offshore

- Domestic

- Fund of funds

By Strategy

- Long/short equity

- Global macro

- Event driven

- Multi strategy

- Long/short credit

- Managed futures/CTA

- Others

Regional Analysis/Coverage

- North America: US, Canada, Mexico

- Europe: Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe

- Asia Pacific: China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific

- Middle East & Africa: UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa

- Latin America: Brazil, Argentina, Rest of Latin America

Buy the Full Hedge Fund Market Report (Single-User License) Now: https://www.snsinsider.com/checkout/6889

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.