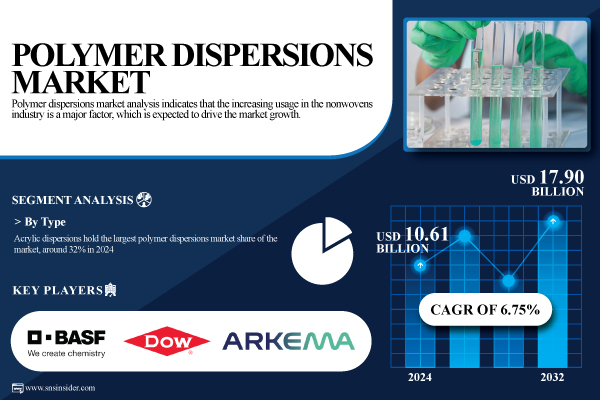

Austin, Aug. 18, 2025 (GLOBE NEWSWIRE) -- The Polymer Dispersions Market Size was valued at USD 10.61 billion in 2024 and is expected to reach USD 17.90 billion by 2032, growing at a CAGR of 6.75% over the forecast period of 2025-2032.

Advancements in Eco-Friendly Coatings Fuel Global Polymer Dispersions Adoption Across Industries

Polymer dispersions are witnessing robust adoption in paints, adhesives, sealants, and textiles, driven by eco-friendly regulations and the transition to water-based solutions. Stricter emission standards have spurred significant demand for low-VOC coatings, prompting expansions like BASF’s Chattanooga plant to cater to construction and packaging needs. Preference for waterborne dispersions in industrial coatings is rising, supported by advancements in acrylic and polyurethane technologies that improve durability and flexibility. Broad application across automotive, construction, and textiles, coupled with sustainability initiatives, is further accelerating global market expansion.

Download PDF Sample of Polymer Dispersions Market @ https://www.snsinsider.com/sample-request/8102

The U.S. Polymer Dispersions market size was USD 3.34 billion in 2024 and is expected to reach USD 5.70 billion by 2032 and grow at a CAGR of 6.92% over the forecast period of 2025-2032.

The U.S. Polymer Dispersions Market is expanding due to rising demand for low-VOC, water-based coatings in construction and automotive applications. Initiatives from the EPA and American Coatings Association have pushed manufacturers to adopt sustainable dispersion technologies, while companies like Dow and BASF are investing in local production capacity to reduce import reliance.

Key Players:

- BASF SE

- Dow Chemical Company

- Arkema S.A.

- Covestro AG

- Wacker Chemie AG

- Synthomer plc

- Celanese Corporation

- DIC Corporation

- Trinseo

- Alberdingk Boley GmbH

- Michelman, Inc.

- Hexion Inc.

- Ashland Global Holdings Inc.

- Chase Corporation

- Lubrizol Corporation

- Scott Bader Company Ltd.

- Mallard Creek Polymers

- OMNOVA Solutions Inc.

- Organik Kimya

- Mitsui Chemicals, Inc.

Polymer Dispersions Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 10.61 Billion |

| Market Size by 2032 | USD 17.90 Billion |

| CAGR | CAGR of 6.75% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Acrylic Dispersions, Polyurethane Dispersions (PUDs), Vinyl Dispersions, Styrene-Butadiene Dispersions, Others (e.g., epoxy dispersions, silicone dispersions) • By Technology (Water-Based Dispersions, Solvent-Based Dispersions, UV-Cured Dispersions, Others (e.g., powder dispersions, high-solid system) • By Application (Paints & Coatings, Adhesives & Sealants, Nonwovens, Printing Inks, Others (e.g., textiles, construction additives)) • By End-Use Industry (Automotive, Construction, Packaging, Textile, Others (e.g., electronics, healthcare) |

If You Need Any Customization on Polymer Dispersions Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8102

By Type, the Acrylic Dispersions dominated the Polymer Dispersions Market in 2024, with a 32% Market Share.

The dominance is due to their versatility, durability, and compliance with environmental regulations. Acrylic dispersions are favored in paints, adhesives, coatings, and textiles for their excellent film-forming ability and water resistance. Waterborne acrylic dispersions help reduce VOC emissions, making them ideal for construction and packaging. Industry leaders like Dow and BASF offer advanced low-VOC products with improved adhesion and weather resistance, while strict compliance policies and growing infrastructure activities further support their widespread adoption.

By End-Use Industry, the Construction Industry Segment dominated the Polymer Dispersions Market in 2024, with a 32% Market Share.

The dominance is due to the rising need for durable, weather-resistant coatings and sealants in infrastructure projects. Increased non-residential construction spending in 2023 significantly boosted demand for waterborne dispersions, known for their crack resistance, adhesion, and eco-friendliness. The American Institute of Architects has reported growing adoption of low-VOC coatings to meet LEED certification goals. Infrastructure investments under the U.S. Infrastructure Investment and Jobs Act and the expansion of eco-friendly product lines by key manufacturers like Arkema have further strengthened construction’s leading position.

By Region, North America dominated the Polymer Dispersions Market in 2024, Holding A 41.30% Market Share.

The dominance is due to advanced manufacturing capabilities, strong regulatory backing, and diverse end-user demand. Stringent VOC limits from the U.S. EPA have driven industries toward water-based dispersions, while infrastructure programs boosted demand for eco-friendly coatings in major construction projects. Key players like Dow and Celanese expanded production to meet needs in construction and packaging. High automotive output in the U.S. and Mexico, combined with consumer sustainability preferences and robust R&D facilities, has positioned the region as a leader in innovative dispersion technologies.

Recent Developments

In January 2025, Arkema introduced ENCOR bio-based waterborne dispersions for textile printing and finishing, offering up to ~30% bio-based content and significant carbon-footprint reductions versus conventional binders, targeting sustainable performance-textile applications.

Buy Full Research Report on Polymer Dispersions Market 2025-2032 @ https://www.snsinsider.com/checkout/8102

USPs of the Polymer Dispersions Market

- Raw Material Price Trend Mapping – Tracks fluctuations in key feedstock costs like monomers and surfactants to assess pricing pressure across global supply chains.

- Export and Import Value Assessment – Evaluates trade flow data to identify top exporting and importing countries, trade imbalances, and cross-border demand dynamics.

- Cost Structure and Margin Analysis – Breaks down production costs and profit margins to understand cost competitiveness and pricing strategies among key players.

- Investment and Expansion Trends – Analyzes capital investments, capacity additions, and geographical expansions made by manufacturers to meet growing demand.

- VOC Emission Reduction Initiatives – Assesses regulatory-driven innovations and adoption of low-VOC or VOC-free polymer dispersions to meet environmental standards.

- Consumption Volume by Application – Measures end-use industry consumption patterns to identify high-demand segments such as paints, adhesives, and textiles.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.