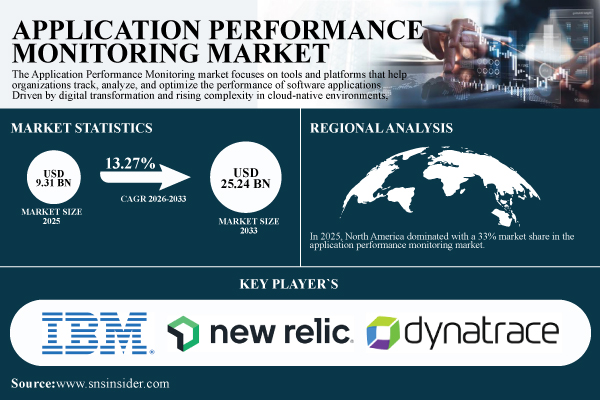

Austin, Dec. 09, 2025 (GLOBE NEWSWIRE) -- The Application Performance Monitoring Market size was valued at USD 9.31 Billion in 2025E and is expected to reach USD 25.24 Billion by 2033, growing at a CAGR of 13.27% over 2026-2033.

The Application Performance Monitoring market focuses on tools and platforms that help organizations track, analyze, and optimize the performance of software applications. Driven by digital transformation and rising complexity in cloud-native environments, APM solutions provide real-time insights into user experience, infrastructure, and application behavior.

Download PDF Sample of Application Performance Monitoring Market @ https://www.snsinsider.com/sample-request/3821

Segmentation Analysis:

By Solution

The software segment led the application performance monitoring market, with 72% market share in 2025. Software solutions offer detailed analytics, automated alerts, and tracking of user behavior, allowing businesses to maintain optimal application functionality. The services segment is anticipated to become the fastest-growing segment in the application performance monitoring market during 2026-2033, driven by the growing complexity of modern IT infrastructures.

By Deployment

The on-premise segment led the market in 2025 with a 58% market share, due to its strong security, control, and compliance features. The cloud segment is going to be the fastest-growing in the APM market during 2026-2033, driven by scalability, cost-effectiveness, and real-time monitoring capabilities.

Regional Insights:

With a 33% market share, North America led the application performance monitoring market in 2025. The extensive adoption of cloud computing, DevOps techniques, and digital transformation in a variety of sectors, including IT, healthcare, and finance, is responsible for this domination. Important firms in this area include Dynatrace, New Relic, and AppDynamics, which offer solutions to track and enhance the functionality of crucial business applications.

In the APM industry, APAC is expected to grow at the quickest rate between 2026 and 2033. APM solutions are being used more and more by sectors, such as manufacturing, telecommunications, and e-commerce to improve digital services and consumer satisfaction. To improve application performance in the area, businesses including Infosys, Alibaba Cloud, and Huawei are using APM tools.

If You Need Any Customization on Application Performance Monitoring Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/3821

Growing Need for Real-time Application Visibility to Support Seamless Digital Experiences Augment Market Expansion Globally

The use of sophisticated Application Performance Monitoring systems is being accelerated by the growing demand for real-time visibility across contemporary, distributed applications. Organizations are increasingly depending on cloud-native architectures, microservices, and APIs as digital platforms grow, which adds to operational complexity.

Asia Pacific is projected to become the fastest-growing region in the APM market during 2026-2033. Industries, such as e-commerce, telecommunications, and manufacturing are increasingly implementing APM solutions to enhance digital services and customer satisfaction. Companies like Huawei, Alibaba Cloud, and Infosys are utilizing APM tools to optimize application performance in the region.

Key Players:

- IBM (IBM Instana, IBM APM)

- New Relic (New Relic One, New Relic Browser)

- Dynatrace (Dynatrace Full-Stack Monitoring, Dynatrace Application Security)

- AppDynamics (AppDynamics APM, AppDynamics Database Monitoring)

- Cisco (Cisco AppDynamics, Cisco ACI Analytics)

- Splunk Inc. (Splunk Observability Cloud, Splunk IT Service Intelligence)

- Micro Focus (Silk Central, LoadRunner)

- Broadcom Inc. (CA APM, CA Application Delivery Analysis)

- Elastic Search B.V. (Elastic APM, Elastic Stack)

- Datadog (Datadog APM, Datadog Real User Monitoring)

- Riverbed Technology (SteelCentral APM, SteelHead)

- SolarWinds (SolarWinds APM, SolarWinds Network Performance Monitor)

- Oracle (Oracle Management Cloud, Oracle Cloud Infrastructure APM)

- ServiceNow (ServiceNow APM, ServiceNow Performance Analytics)

- Red Hat (Red Hat OpenShift Monitoring, Red Hat Insights)

- AppOptics (AppOptics APM, AppOptics Infrastructure Monitoring)

- Honeycomb (Honeycomb APM, Honeycomb Distributed Tracing)

- Instana (Instana APM, Instana Real User Monitoring)

- Scout APM (Scout APM, Scout Error Tracking)

- Sentry (Sentry APM, Sentry Error Tracking)

Recent Developments:

- 2024: New Relic launched a fully integrated, AI-driven Digital Experience Monitoring (DEM) solution, combining real-user monitoring, mobile & web, APM 360, session replay, and AI monitoring for end-to-end visibility across application stacks.

- 2024: Cisco released Smart Agent for AppDynamics to simplify distributed-application instrumentation and agent lifecycle management, making full-stack observability easier to deploy across applications and infrastructures.

Buy Full Research Report on Application Performance Monitoring Market 2026-2033 @ https://www.snsinsider.com/checkout/3821

Exclusive Sections of the Report (The USPs):

- PRICING & COST-EFFICIENCY BENCHMARKS – helps you compare subscription prices across deployment types, evaluate per-host/transaction cost models, and track emerging pricing structures such as usage-based or feature-based models.

- REGULATORY & DATA COMPLIANCE INDEX – helps you understand how GDPR, CCPA, HIPAA, and regional compliance burdens influence APM adoption, along with certification standards (ISO, SOC 2, FedRAMP) that vendors must meet.

- IT WORKLOAD & CLOUD MONITORING STATISTICS – helps you assess how APM tools are deployed across IaaS, PaaS, and SaaS environments, including adoption in microservices, Kubernetes, and serverless architectures.

- PERFORMANCE & INCIDENT-REDUCTION METRICS – helps you measure improvements in MTTD, MTTR, uptime, and incident reduction after APM deployment, enabling enterprises to quantify operational efficiency gains.

- AIOps & AUTOMATION ADOPTION RATE – helps you identify how widely APM platforms integrate AIOps features such as automated root-cause analysis, anomaly detection, and predictive incident alerts.

- COMPETITIVE LANDSCAPE & VENDOR BENCHMARKING – helps you compare leading APM vendors based on pricing strength, market positioning, technological upgrades, and capability enhancements in observability and automation.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.