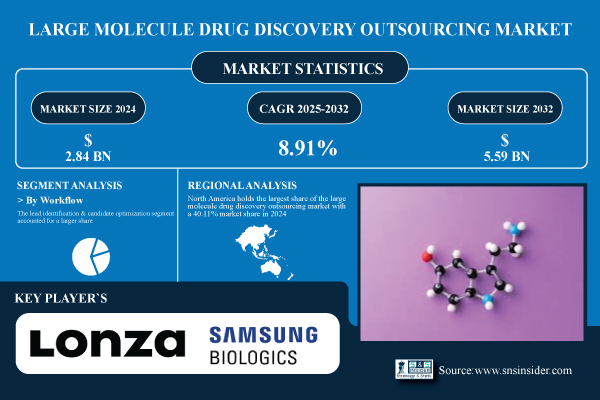

Austin, Dec. 12, 2025 (GLOBE NEWSWIRE) -- As per SNS Insider Research, The Large Molecule Drug Discovery Outsourcing Market size was valued at USD 2.84 billion in 2024 and is expected to reach USD 5.59 billion by 2032, growing at a CAGR of 8.91% over 2025-2032. The strong growth in the global large-molecule drug discovery outsourcing market is mainly driven by the growing demand for biologics, including large-molecule drugs, such as monoclonal antibodies, recombinant proteins, and gene therapies.

The U.S. large molecule drug discovery outsourcing market size was valued at USD 0.87 billion in 2024 and is expected to reach USD 1.68 billion by 2032, growing at a CAGR of 8.68% over 2025-2032. The North American market is dominated by the U.S., as it has an advanced and robust biopharmaceutical infrastructure, presence of global CDMO and CRO industry, and concentration of biotech companies in the U.S.

Get a Sample Report of Large Molecule Drug Discovery Outsourcing Market: https://www.snsinsider.com/sample-request/7663

Increasing Demand for Biologics is Propelling Market Growth Globally

Due to its high specificity and great efficacy in treating chronic, complex, and previously incurable diseases, such as cancer, autoimmune disorders, and uncommon genetic problems, biologics demand (monoclonal antibodies, recombinant proteins, and nucleic acid-based medicines) is increasing. Drug makers are increasingly turning to outsourcing discovery operations in order to access specialized talents, accelerate early R&D, and reduce internal strain as biologics become the mainstay of pharmaceutical pipelines. The market for outsourcing large molecule drug discovery services is expanding as a result of this shift.

Regulatory Challenges and Quality Compliance Can Restrict Market Growth Glbally

The strict regulatory environment for biologics development has a major impact on the growth of the large molecule drug discovery outsourcing market. Strict guidelines are enforced by the FDA, EMA, ICH, and other organizations, and accompanying documentation must include details about the product's quality, safety, efficacy, production consistency, and, in the case of biologics, bioanalytical data. Defective outsourcing partners might result in project delays, unsuccessful approvals, or expensive repeat studies, especially when it comes to early discovery, preclinical, and assay development.

Major Players Analysis Listed in the Large Molecule Drug Discovery Outsourcing Market Report are

- Lonza Group

- Catalent

- Samsung Biologics

- Thermo Fisher Scientific

- WuXi AppTec

- Charles River Laboratories

- Evotec SE

- GenScript Biotech Corporation

- Eurofins Scientific

- Syngene International Ltd.

- Other players.

Large Molecule Drug Discovery Outsourcing Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | USD 2.84 Billion |

| Market Size by 2032 | USD 5.59 Billion |

| CAGR | CAGR of 8.91% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Key Segments | • By Workflow (Target Identification & Screening, Target Validation & Functional Informatics, Lead Identification & Candidate Optimization, Preclinical Development, Others) • By Service (Chemistry Services, Biology Services) • By Therapeutic Area (Respiratory System, Pain and Anesthesia, Oncology, Ophthalmology, Hematology, Cardiovascular, Endocrine, Gastrointestinal, Immunomodulation, Anti-infective, Central Nervous System, Dermatology, Genitourinary System) • By End Use (Pharmaceutical & Biotechnology Companies, Academic Institutes) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

For a Personalized Briefing with Our Industry Analysts, Connect Now: https://www.snsinsider.com/request-analyst/7663

Segmentation Analysis:

By Workflow

The lead identification & candidate optimization segment accounted for a larger share of the large molecule drug discovery outsourcing market in 2024, with a 31.25%, owing to its pivotal role in the early stages of any biologics’ development process. The preclinical development segment is estimated to witness the highest CAGR during the forecast period. The need for speed, along with increasing biologics pipelines, is forcing a greater number of companies to outsource preclinical testing to reduce development timelines in-house and channel internal resources into competitive competencies.

By Service

In 2024, the biology services segment dominated the large molecule drug discovery outsourcing market share with a 78.23% in 2024, owing to the complex and biologically intensive nature of large molecule development. The chemistry services segment is expected to grow at the fastest rate during the forecast period, owing to the increasing demand for structural characterization, stability studies, conjugation chemistry, and bioanalytical testing.

By Therapeutics Area

The large molecule drug discovery outsourcing market was dominated by the respiratory system segment in 2024, with a 28.62% market share, due to the global burden of respiratory diseases, including asthma, COPD, and respiratory infections. The oncology segment is expected to be the fastest-growing segment over the forecast period, due to the increasing prevalence of cancer worldwide, which has put a significant focus on developing new biologic therapies.

By End-Use

The pharmaceutical & biotechnology companies segment held the largest share in the large molecule drug discovery outsourcing market in 2024, with 76.2% market share, as the demand for cost-effective and time-efficient methods for developing biologics, such as monoclonal antibodies, recombinant proteins, and cell therapies, continues to rise. The academic institutes segment is expected to be the fastest growing during the forecast years, attributed to increasing funding for translational research and growing public-private partnerships.

Regional Insights:

North America holds the largest share of the large molecule drug discovery outsourcing market with a 40.11% market share in 2024, which can be attributed to the mature biopharmaceutical ecosystem, established presence of the leading contract research and development organizations (CROs and CDMOs), and high expenditure on biologics research and development in the region.

With a 9.22% compound annual growth rate (CAGR), the large molecule drug discovery outsourcing market in Asia Pacific is expanding significantly due to factors, such as reduced operating costs, more biologics expertise, and increased government backing for pharmaceutical innovation in the area.

Purchase Single User PDF of Large Molecule Drug Discovery Outsourcing Market Report (20% Discount): https://www.snsinsider.com/checkout/7663

Recent Developments:

- May 2025 – Lonza, a premier CDMO, launched its groundbreaking Design2Optimize platform to drive process development and manufacturing of small-molecule APIs forward. The new platform is intended to optimize development workflows, improve process efficiency, and advance time-to-market for pharma industry clients.

- May 2025 – Catalent emphasized its enhanced mammalian cell line engineering and biomanufacturing capabilities, using single-use systems to provide increased flexibility and scalability. From its state-of-the-art facility in Madison, Wisconsin, Catalent now provides an integrated package of formulation and analytical services to support challenging biologics development issues.

Exclusive Sections of the Report (The USPs):

- CLOUD INFRASTRUCTURE UTILIZATION RATES – helps you assess the efficiency and scalability of IaaS and PaaS deployments across data centers, revealing whether providers are optimizing resources or facing overcapacity issues.

- TECHNOLOGY ADOPTION INDEX – helps you identify trends in AI, containerization, Kubernetes, and serverless computing integration across IaaS and PaaS platforms, uncovering opportunities for innovation and investment.

- COST OPTIMIZATION & PRICING BENCHMARKS – helps you understand pricing dynamics, cost-per-instance comparisons, and subscription models across major providers, supporting ROI evaluation for enterprises.

- REGULATORY & DATA COMPLIANCE METRICS – helps you track adherence to GDPR, HIPAA, and regional data sovereignty laws, ensuring risk mitigation for cloud infrastructure and service providers.

- SERVICE RELIABILITY & PERFORMANCE INDICATORS – helps you evaluate uptime percentages, latency levels, and disaster recovery performance, providing insights into operational resilience and service quality.

- COMPETITIVE LANDSCAPE ANALYSIS – helps you benchmark leading cloud providers based on market share, customer satisfaction, innovation investments, and geographic service expansion trends.

Access Complete Report Details of Large Molecule Drug Discovery Outsourcing Market Analysis & Outlook: https://www.snsinsider.com/reports/large-molecule-drug-discovery-outsourcing-market-7663

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.