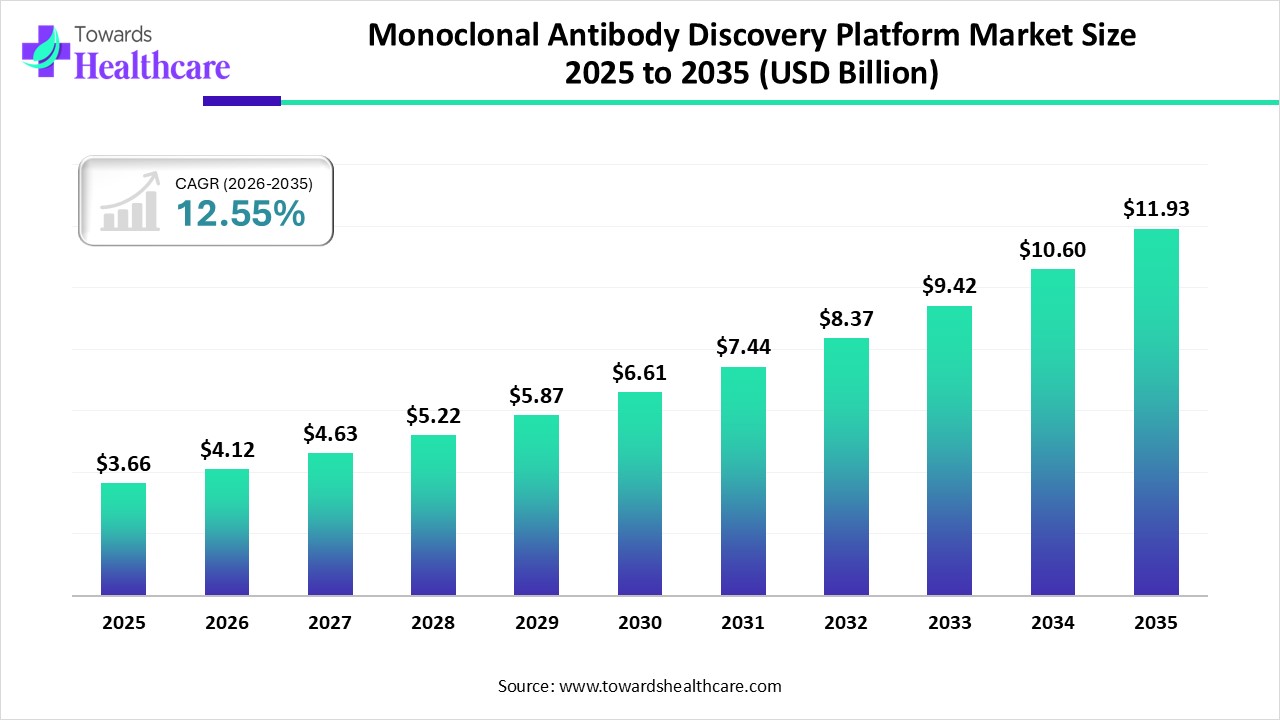

Ottawa, Dec. 18, 2025 (GLOBE NEWSWIRE) -- The global monoclonal antibody discovery platform market size is calculated at USD 4.12 billion in 2026 and is expected to reach around USD 11.93 billion by 2035, growing at a CAGR of 12.55% for the forecasted period. Market projects strong progression fueled by escalated investments, innovation, and increasing demand across diverse industries.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6357

Key Takeaways

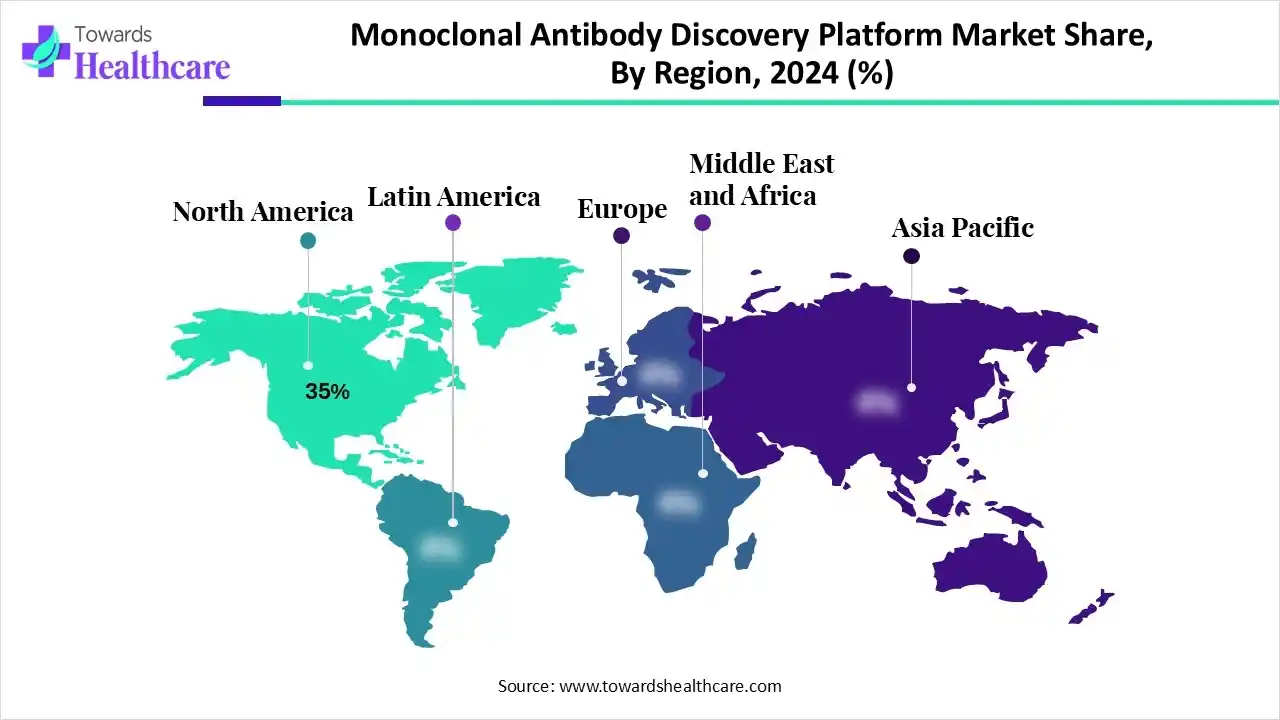

- North America dominated the market in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR during 2025-2034.

- By technology/platform type, the phage display segment was dominant in the market in 2024.

- By technology/platform type, the computational/in-silico discovery platforms segment is expected to witness rapid expansion in the coming years.

- By antibody type, the full-length monoclonal antibodies segment captured a major share of the monoclonal antibody discovery platform market in 2024.

- By antibody type, the bispecific/multispecific antibodies segment is expected to grow rapidly in the studied years.

- By end-user, the pharmaceutical & biopharmaceutical companies segment led the market in 2024.

- By end-user, the contract research organizations (CROs) segment is expected to be the fastest-growing during 2025-2034.

- By application, the oncology segment captured the largest revenue share of the market in 2024.

- By application, the autoimmune diseases segment is expected to witness rapid expansion in the upcoming years.

How is the Monoclonal Antibody Discovery Platform Transforming?

Mainly, the coverage of a set of integrated technologies and processes for detecting and establishing particular, identical antibodies (from a single B-cell clone) to target a specific disease-causing molecule (epitope) for diagnosis or therapy refers to the monoclonal antibody discovery platform market. The overall market growth is propelled by the rising outsourcing to CROs, novel formats (bispecifics), enhancing therapeutic areas (oncology, autoimmune), supportive regulations, and tech convergence. Whereas, in 2025, Sibeprenlimab, an investigational human mAb for IgA nephropathy (IgAN) developed to target the APRIL cytokine, is currently under FDA priority review.

What are the Prominent Drivers Involved in the Market Expansion?

A rise in cancer, autoimmune diseases, and infectious diseases cases is highly demanding novel and more effective mAb treatments. This further boosters the transformation of bispecific antibodies, antibody fragments, and ADCs (Antibody-Drug Conjugates). However, many biotechnology companies are taking substantial steps into recombinant DNA, AI-enabled analysis, microfluidics, and enhanced cell culture, which further accelerate discovery and efficiency.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Trends in the Monoclonal Antibody Discovery Platform Market?

- In December 2025, InduPro, Inc., a biotechnology company, announced a strategic equity investment and research collaboration with Sanofi to develop new therapeutics for the treatment of cancer and autoimmune diseases.

- In October 2025, Boehringer Ingelheim and AimedBio, a biotechnology company, collaborated on and licensing agreement to create a novel antibody-drug conjugate (ADC) therapy for various kinds of cancers.

- In June 2025, Bio-Techne Corporation announced a distribution agreement with the U.S. Pharmacopeia (USP) to allow the Company to sell USP monoclonal antibody (mAb) and recombinant adeno-associated virus (AAV) reference standards with its analytical solutions.

What is the Vital Challenge in the Monoclonal Antibody Discovery Platform Market?

The need for higher costs of a billion dollars in the discovery and a long timeline for the development, with minimum success rates, is specifically generating a barrier among a number of biotechnology companies. It is difficult to ensure long-term safety and immunogenicity of these products.

Regional Analysis

Why did North America Dominate the Market in 2024?

By capturing a dominant share of 35%, North America led the market in 2024. The regional expansion is mainly driven by the presence of robust R&D, advanced infrastructure, high healthcare expenditure, and supportive FDA regulations. Recent developments include single-cell screening by Yurogen, AI-powered engineering by Benevolent AI/Sanofi, Earendil, and sophisticated transgeneic models by Regeneron’s VelocImmune.

For instance,

- In November 2025, iOrganBio launched CellForge with $2M funding to transform cell manufacturing.

How did the Asia Pacific Grow Significantly in the Market in 2024?

In the coming era, the Asia Pacific is anticipated to expand rapidly in the monoclonal antibody discovery platform market. The region is widely offering immersive, affordable R&D capabilities and a rise in talent pool, which is appealing to global partnerships. Major global firms, such as Invenra, are collaborating with companies, like Orion, for the exploration of advanced solutions for new cancer mAbs. However, Sigma-Aldrich's Mobius ADC platform is providing expedited, scalable ADC development, crucial for regional oncology pipelines.

For instance,

- In September 2025, Starpharma, an Australian biotechnology company, signed a collaboration and license agreement with Genentech to explore potential cancer therapies by using Starpharma’s proprietary DEP drug delivery technology.

Ongoing Clinical Trials in the Monoclonal Antibody Discovery Platform Market in 2025

| Sponsor | Study Title |

| University of Cambridge | IVIG and Rituximab in Antibody-associated Psychosis - SINAPPS2 (SINAPPS2) |

| Institute of Hematology & Blood Diseases Hospital, China | Rituximab Combining Anti-CD38 Monoclonal Antibody Versus Rituximab in the Management of Primary Immune Thrombocytopenia (ITP) |

| Tongji Hospital | Monoclonal Antibody-Based Therapies for AQP4-Positive NMOSD |

| Institute of Hematology & Blood Diseases Hospital, China | TPO-RAs Combining Anti-CD 20 Monoclonal Antibody Versus TPO-RAs in the Management of Pediatric Primary Immune Thrombocytopenia (ITP) |

| Assistance Publique - Hôpitaux de Paris | Personalized Therapies in Inflammatory Complex Disease (PIMOC) |

| Incyte Corporation | Study to Assess the Safety and Tolerability of Tafasitamab in Adult Participants with Primary Autoimmune Blood Cell Disorders |

| University of California, San Diego | Stelara and Tremfya Pregnancy Exposure Registry OTIS Autoimmune Diseases in Pregnancy Project |

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By technology/platform type

What Made the Phage Display Segment Dominant in the Market in 2024?

In the monoclonal antibody discovery platform market, the phage display segment held the largest revenue share in 2024. The technology enables quicker screening of vast (10^9-10^11) libraries for high-affinity binders, bypassing animal immunization, and allowing selection against difficult/toxic targets, even intracellularly. The era is employing yeast display for "post-panning" enhancement to fine-tune antibody developability (affinity, stability, expression) after initial phage selection.

On the other hand, the computational/in-silico discovery platforms segment will expand rapidly. Researchers are increasingly adopting homology modeling, docking for the prediction of 3D mAb-antigen complexes and identification of key binding residues. Currently, they have used sequence-based ML models (like those in PROPERMAB) to predict properties, including viscosity, identifying "liabilities" early on. Also, the market is pushing generative models for new sequences and language modeling of repertoires, which crucially boosts the development of targets, mainly SARS-CoV-2 and beyond.

By antibody type analysis

Why did the Full-Length Monoclonal Antibodies Segment Lead the Market in 2024?

In 2024, the full-length monoclonal antibodies segment dominated the monoclonal antibody discovery platform market. The high target binding of these antibodies and the raised preference for humanized mAbs to lower immunogenicity are promoting their adoption. For their discovery, the Beacon platform enables high-throughput screening, displaying functional antibodies (agonists/antagonists) and allowing faster discovery from a variety of species (mice, rabbits, alpacas).

Moreover, the bispecific/multispecific antibodies segment is predicted to expand fastest. The segmental growth is fueled by dual-targeting for complex diseases, with increased effectiveness, eliminating drug resistance, and further allowing tailored medicine, with optimised cell engagement in cancers and autoimmune disorders. This era comprises Blinatumomab (CD19/CD3 for leukaemia), Emicizumab (for Haemophilia A), and pipeline drugs, including Sonelokimab.

By end-user analysis

How did the Pharmaceutical & Biopharmaceutical Companies Segment Lead the Market in 2024?

The pharmaceutical & biopharmaceutical companies segment captured the dominating share of the monoclonal antibody discovery platform market in 2024. These companies are increasingly fostering the development of bispecific, trispecific antibodies by the wider adoption of AI/ML in their discovery for robust evaluation of complex antibody combinations. Recently, MDPI addressed the growth of rabbit mAbs for superior affinity and recognition of complex epitopes, valuable for ADCs and checkpoint inhibitors.

Moreover, the contract research organizations (CROs) segment is predicted to expand rapidly. CROs are primarily involved in the creation of mAbs for targeted cancer therapies, like blocking immune checkpoints, such as PD-1/PD-L1, and ADCs. The latest instance is among Spice Biotechnologies & AbTherx through a multi-program collaboration for next-generation immunotherapy antibodies.

By application analysis

Which Application Led the Monoclonal Antibody Discovery Platform Market in 2024?

The oncology segment registered dominance with a major share of the market in 2024. The increasing burden of cancer cases, demand for targeted therapies, and the development of genetic engineering are supporting the oncology sector. Along with a focus on personalized treatments, the market has unveiled Harbour BioMed, integrated AI with transgenic mice, and made a deal with Sanofi licensing bispecifics from Erendil Labs to encourage, pushing bispecifics, ADCs, and immune checkpoint inhibitors to the significant for tailored cancer treatment.

Besides this, the autoimmune diseases segment is anticipated to witness rapid expansion. The recent progression driven by persistent research activities, like the Nipocalimab (Imaavy), a fully human FcRn-blocking mAb, which received European Commission approval in 2025 (and prior FDA approval) for the treatment of a wider population of adults and adolescents with generalized myasthenia gravis (gMG). Whereas, depemokimab, an ultra-long-acting anti-interleukin-5 (IL-5) mAb, is in late-stage development and under regulatory review in different regions, it introduced treatment for severe asthma and chronic rhinosinusitis with nasal polyps.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Recent Developments in the Monoclonal Antibody Discovery Platform Market

- In December 2025, Incyte revealed new clinical data from two Phase 1 studies of INCA033989, a first-in-class mutant calreticulin (mutCALR)-targeted monoclonal antibody, for patients with mutCALR-expressing myeloproliferative neoplasms (MPNs).

- In October 2025, Harbour BioMed, a global biopharmaceutical company, launched its first fully human Generative AI HCAb (Heavy Chain-Only Antibody) Model led by its Hu-mAtrIx AI platform.

- In October 2025, 10x Genomics, Inc. unveiled the next generation of its high-performance Flex assay to enable scientists to scale single-cell research.

- In May 2025, Invenra Inc., a developer in multispecific antibody discovery and development, launched its T-Body trispecific antibody platform, a next-generation technology.

Browse More Insights of Towards Healthcare:

The monoclonal antibody for asthma and COPD market size was valued at US$ 34.02 billion in 2025 and is projected to grow to 35.94 billion in 2026. Forecasts suggest it will reach approximately US$ 58.94 billion by 2035, registering a CAGR of 5.65% during the period.

The global monoclonal antibodies therapeutics market size is calculated at US$ 265.17 in 2024, grew to US$ 304.52 billion in 2025, and is projected to reach around US$ 1057.91 billion by 2034. The market is expanding at a CAGR of 14.84% between 2025 and 2034.

The global monoclonal antibodies in veterinary health market size is calculated at US$ 1.23 in 2024, grew to US$ 1.45 billion in 2025, and is projected to reach around US$ 6 billion by 2034. The market is expanding at a CAGR of 17.13% between 2025 and 2034.

The global biologics safety testing market size is calculated at USD 4.03 billion in 2024, grew to USD 4.58 billion in 2025, and is projected to reach around USD 14.45 billion by 2034. The market is expanding at a CAGR of 13.64% between 2025 and 2034.

The global oncology biosimilars market size is calculated at US$ 6.7 billion in 2024, grew to US$ 7.94 billion in 2025, and is projected to reach around US$ 36.23 billion by 2034. The market is expanding at a CAGR of 18.47% between 2025 and 2034.

The global antibody optimization service market size is calculated at US$ 2.77 billion in 2024, grew to US$ 3 billion in 2025, and is projected to reach around US$ 6.07 billion by 2034. The market is expanding at a CAGR of 8.45% between 2025 and 2034.

The global antibody discovery market size was reported at US$ 8.31 billion in 2024 and is expected to rise to US$ 9.1 billion in 2025. According to forecasts, it will grow at a CAGR of 9.54% to reach US$ 20.71 billion by 2034.

The global antibody drug conjugate (ADC) market size is projected to grow from USD 13.51 billion in 2025 to USD 32.66 billion by 2035, at a compound annual growth rate (CAGR) of 9.23% from 2026 to 2035.

The modified antibody market size recorded US$ 3.10 billion in 2025, set to grow to US$ 3.38 billion in 2026 and projected to hit nearly US$ 7.36 billion by 2035, with a CAGR of 9.04% throughout the forecast timeline from 2026 to 2035.

The global human combinatorial antibody libraries market size is calculated at US$ 116.2 in 2024, grew to US$ 122 million in 2025, and is projected to reach around US$ 189.57 million by 2034. The market is expanding at a CAGR of 5.04% between 2025 and 2034.

Monoclonal Antibody Discovery Platform Market Key Players List

- Thermo Fisher Scientific

- Charles River Laboratories

- WuXi AppTec / WuXi Biologics

- AbCellera

- Adimab

- Abcam

- GenScript Biotech (GenScript / GenScript ProBio)

- Twist Bioscience

- Creative Biolabs

- Sartorius

- Biocytogen

- Abveris

- Abzena

- LakePharma

- ImmunoPrecise Antibodies

- Integral Molecular

- GigaGen

- Morphosys

- Regeneron Pharmaceuticals (VelocImmune platform)

- Bio-Rad Laboratories

Segments Covered in the Report

By Technology / Platform Type

- Hybridoma Technology

- Conventional Hybridoma

- Single-Cell Hybridoma

- Phage Display

- Standard Phage Display

- Next-Generation Phage Display

- Yeast Display

- Conventional Yeast Display

- Engineered Yeast Display

- Mammalian Cell Display

- Ribosome Display

- Computational / In-Silico Discovery Platforms

By Antibody Type

- Full-Length Monoclonal Antibodies

- Antibody Fragments

- Fab

- scFv

- VHH / Nanobody

- Bispecific / Multispecific Antibodies

- Antibody-Drug Conjugates (ADC)

By End-User

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Diagnostic Companies

By Application

- Oncology

- Autoimmune Diseases

- Infectious Diseases

- Neurological Disorders

- Cardiovascular Diseases

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6357

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest