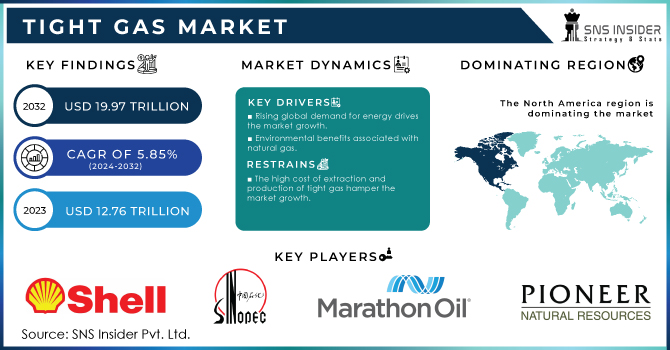

Austin, Aug. 01, 2024 (GLOBE NEWSWIRE) -- The Tight Gas Market Size is projected to reach USD 19.97 Trillion cubic feet by 2032 and grow at a CAGR of 5.85% over the forecast period of 2024-2032.

Get a Sample Report of Tight Gas Market @ https://www.snsinsider.com/sample-request/1509

Key players:

- Royal Dutch Shell

- Sinopec

- Marathon Oil

- Pioneer Natural Resources

- EOG Resources

- British petroleum

- Exxon Mobil

- Chesapeake Energy Total SA

- PetroChina

- Anadarko Petroleum Co.

- Devon Energy

Improved technology advancements drive market growth.

The efficiency and feasibility of tight gas extraction have increased owing to advancements in horizontal drilling and hydraulic fracturing. These technologies make access to previously unprofitable reserves possible, increasing overall production drive the market growth.

The expansion of natural gas infrastructure is crucial for the efficient transport and commercialization of tight gas, significantly supporting market growth. Key developments include the construction of extensive pipeline networks, such as the expansion of the Transco pipeline system in the United States, which connects major tight gas production areas to high-demand regions.

Additionally, new storage facilities, like the Salt Cavern Storage project in Texas, enhance supply stability and meet peak demand periods. Export terminals, such as the Sabine Pass LNG terminal, enable the global distribution of U.S. tight gas, tapping into international markets. These infrastructure projects collectively ensure a reliable and efficient supply chain, bolstering the tight gas market.

For instance, in 2023, ExxonMobil announced a USD 3 billion investment to expand its tight gas operations in the Permian Basin, focusing on enhanced hydraulic fracturing techniques and increasing production capacity.

Furthermore, many governments are providing tax benefits, subsidies, and regulatory support to encourage the development of domestic natural gas resources, including tight gas, to enhance energy security and reduce import dependency.

Tight Gas Market Report Scope & Overview:

| Report Attributes | Details |

| Market Size in 2023 | USD 12.76 trillion cubic feet |

| Market Size in 2032 | USD 19.97 trillion cubic feet |

| CAGR (2024-2032) | 5.85% |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Market Driver |

|

Do you need any customization research on Tight Gas Market, Speak to Our Analyst @ https://www.snsinsider.com/enquiry/1509

Segmentation Analysis

By Type

- Processed Tight Gas

- Unprocessed Tight Gas

The processed tight gas segment is leading due to its higher value and broader applicability. Processed tight gas, which has undergone treatment to remove impurities and contaminants, is preferred by end-users for its quality and efficiency. This processing ensures that the gas meets stringent standards for use in power generation, industrial applications, and as a feedstock in chemical manufacturing. The refined nature of processed tight gas allows for better energy output and reduced environmental impact compared to unprocessed gas.

By Application

- Residential

- Commercial

- Industrial

- Power Generation

- Transportation

- Others

The industrial segment held the largest market share around 37% share of global revenue in 2023 by application segment due to its diverse uses, cost efficiency, and environmental benefits. Natural gas is a versatile energy source used in producing chemicals, fertilizers, and hydrogen, as well as in metal smelting and glass manufacturing. Its relatively lower and stable prices make it an attractive option for industries looking to reduce operational costs. Besides, characteristic gas burns cleaner than coal and oil, emanating less toxins and nursery gasses, which makes a difference businesses comply with natural directions. The reliable supply of natural gas, ensured by extensive infrastructure like pipelines and storage facilities, is crucial for continuous industrial operations.

Regional Landscape:

The North America region held the largest market share in the medical textile market, around 62% revenue share in 2023. The region is leading because of its substantial shale reserves, cutting-edge extraction techniques, and favourable legislative framework. Particularly in the United States, horizontal drilling and hydraulic fracturing were pioneered, greatly increasing the production of tight gas. The U.S. Energy Information Administration reports that tight gas extraction was a major factor in the record-breaking 34.5 trillion cubic feet of dry natural gas produced in the United States in 2022.

Furthermore, the North American market enjoys the advantages of a sizable infrastructure, which includes vast pipeline networks and storage facilities. Market leadership is further enhanced by recent developments, such as the growth of export terminals like the Sabine Pass LNG facility and the support of the US government for domestic energy production

Recent Developments

- In 2023 BP invested USD 2.2 billion in expanding its tight gas operations in the Eagle Ford Shale. The investment includes the development of new wells and the upgrade of existing infrastructure to enhance production and reduce emissions.

- In 2023, Chesapeake Energy invested USD 1.4 billion in a new drilling program in the Haynesville Shale, focusing on tight gas extraction. The program aims to increase production capacity and includes the construction of new export terminals to facilitate global distribution.

- In 2022, Chevron launched a new drilling program in the Marcellus Shale, investing USD 1.5 billion to develop tight gas wells. The program includes the use of advanced drilling technologies to improve extraction efficiency and reduce environmental impact.

Buy an Enterprise User PDF of Tight Gas Market Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/1509

Key Takeaways:

- Increasing demand for cleaner energy sources drives tight gas market growth.

- The industrial sector holds the largest market share due to diverse natural gas uses.

- North America leads the market with vast reserves and advanced extraction technologies.

- Supportive policies and incentives encourage investment in tight gas development.

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Tight Gas Market Segmentation, By Type

8. Tight Gas Market Segmentation, By Application

9. Regional Analysis

10. Company Profiles

11. Competitive Landscape

12. Use Case and Best Practices

13. Conclusion

Access Complete Report Details @ https://www.snsinsider.com/reports/tight-gas-market-1509

About SNS Insider

At SNS Insider, we believe that businesses should have access to the best market intelligence and insights, regardless of their size or industry. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to big corporations. With a passion for our work and an unwavering commitment to delivering value, we are dedicated to helping our clients achieve their full potential.